Simple in name, hard to achieve: companies to miss 2020 zero-deforestation commitments

- Sarah Brickman

- Mar 21, 2020

- 9 min read

Updated: Sep 15, 2021

Nearly a decade ago, the world’s largest food companies set a momentous goal: they would eliminate deforestation from their supply chains by 2020. Now, as the deadline approaches, the private sector is admitting that it will break this promise. Companies are shifting their zero-deforestation targets to 2025 or 2030, and in the meantime, forests will continue being destroyed and replaced with agricultural land to feed and fuel the world.

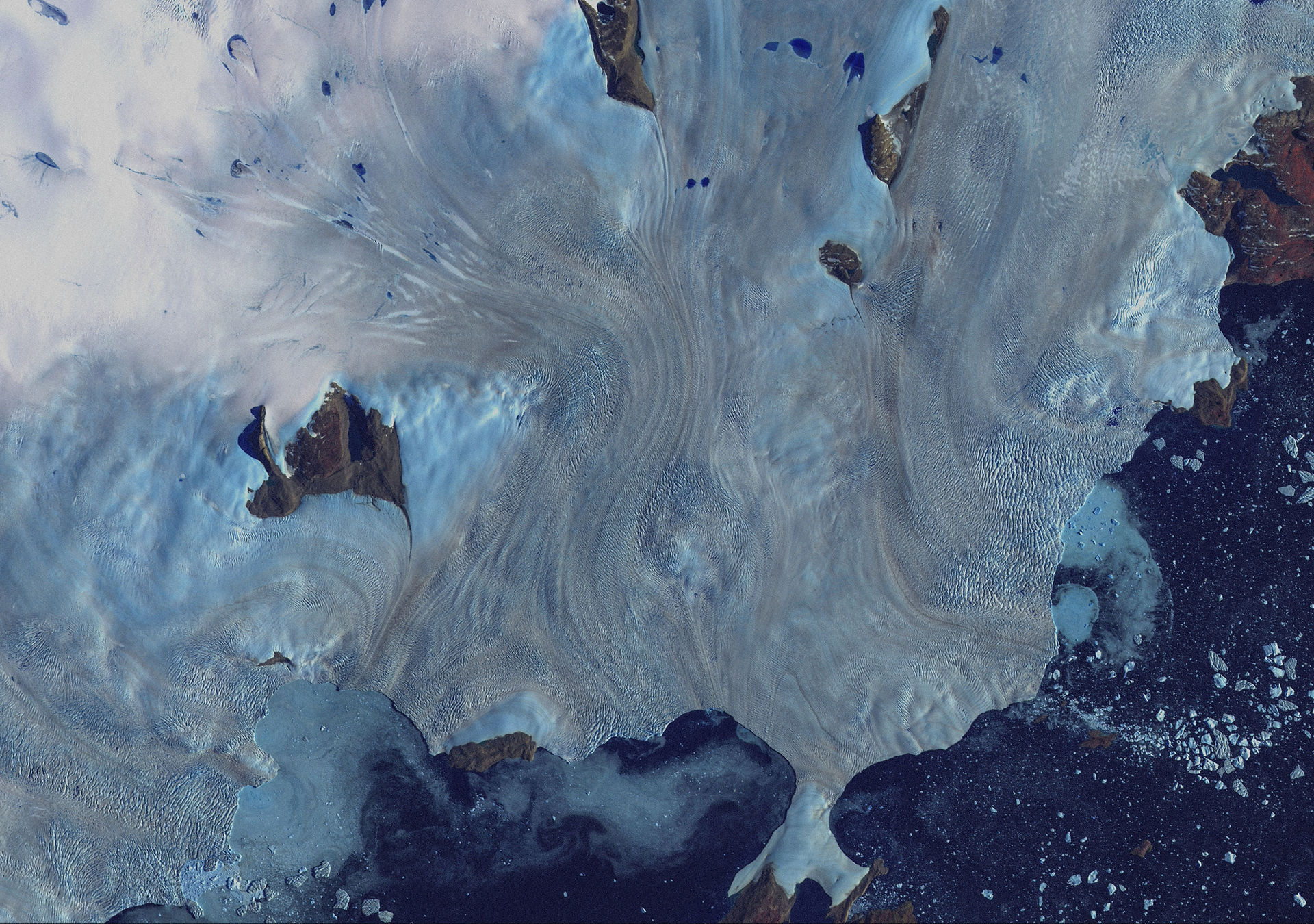

Commodity-driven deforestation accounts for more than a quarter of forest loss worldwide, with some of the major products and regions of concern being soy and cattle in South America and palm oil in Southeast Asia. Soy is primarily turned into animal feed, while palm oil is used in processed food and cosmetics. Both are also burned as biodiesel.

Most commodity-driven deforestation occurs in tropical forests, which are not only home to a disproportionate number of the world’s organisms, but also sequester carbon in their vegetation and soil. When forests are destroyed to make way for agriculture, they transform from carbon sink to source, and this change is significant: since 2014, average annual emissions from tropical tree cover loss have exceeded the European Union’s total annual emissions across all sectors.

In 2010, the Consumer Goods Forum (CGF), a membership-based organization that includes hundreds of multinational companies, took aim at this land conversion by committing to achieving zero net deforestation in commodity supply chains by 2020. (Zero net deforestation allows deforestation to still occur, as long as it is offset by reforestation.) In response to the CGF commitment, the Tropical Forest Alliance 2020 was founded in 2012 to mobilise the public and private sectors toward action, and the world’s largest agricultural traders and consumer brands joined as members. Then, in 2014, companies again made a voluntary commitment to eliminate deforestation (not net deforestation) from the production of agricultural commodities when the New York Declaration on Forests (NYDF) was signed at the United Nations Climate Summit. As of November 2019, NYDF supporters include 60 multinational companies, 41 national governments, 21 subnational governments, 22 groups representing Indigenous communities, and 65 nongovernmental organisations. In total, 481 companies have made a combined 850 commitments to halting deforestation within their supply chains, yet not a single one is prepared to claim success by their original deadline, 2020.

'When the goals were developed or agreed to, I don’t think that the companies who had agreed to them had an idea of how challenging it would be to meet', said Nathalie Walker, Tropical Forest and Agriculture Director at the National Wildlife Federation. 'The ambition was as if I say I’m going to lose 40 pounds but I don’t have any intention of not eating cookies every day or have no plan to work out, I just say “Oh yeah, I want to lose 40 pounds”. It’s kind of like they did that.'

Eric Lambin, professor of earth system science at Stanford University and Université catholique de Louvain, added that in the early days of deforestation commitments, 'there was a kind of naïve expectation that it would be very simple, very fast, or they would make a commitment and boom, that would solve the issues.'

In fact, the issues are far from solved: deforestation is on the rise. Since the NYDF was signed, average annual humid tropical primary forest loss has equaled 4.3 million hectares per year, a staggering increase over the 2002-2013 baseline of 3 million hectares per year. In addition, the global average rate of gross tree cover loss jumped from 18.3 to 26.1 million hectares per year.

In the context of increasing forest cover loss, agricultural traders, manufacturers, and retailers with zero-deforestation commitments are trying to figure out how to ensure this environmental destruction doesn’t end up in their supply chains and in our shopping carts. It’s disappointing, but not surprising, that companies won’t achieve this feat by 2020. Some companies simply haven’t invested sufficient resources to meeting the 2020 deadline – or haven’t made any zero-deforestation commitments at all. Yet even those companies that have been earnestly striving to cleanup their supply chains have faced a number of obstacles, highlighting the complexity that underlies a seemingly straightforward goal.

Traceability and transparency still lacking

For a company to ensure that its supply chain is deforestation-free, it needs to trace its supply chain upstream to the farmer or rancher. Most companies with zero-deforestation commitments don’t purchase from these raw material producers directly; rather, there are often multiple suppliers between the farmers and ranchers and the ultimate purchaser. Therefore, deforestation linked to agricultural production may lurk within companies’ indirect supply chains, making it more difficult for companies to identify and track.

'Right now, NGOs are often asking companies to disclose things they don’t even have information about', said Crystal Davis, Director of Global Forest Watch. 'We can march around demanding transparency and disclosure from companies, but it’s really about a road to transparency and disclosure that we need to slowly walk them down.'

At a high level, traceability and transparency of commodity supply chains is mixed. Out of all commodities, palm oil has probably seen the most progress in this area. As part of their 'No Deforestation, No Peat, No Exploitation' commitments, the world’s largest palm oil traders have traced their supply chains and published supplier lists on their websites. While advancements in palm oil traceability allow companies to better monitor themselves, the high level of transparency provided via the supplier lists simultaneously enables civil society to independently monitor the industry.

However, not all commodity supply chains have achieved the same level of traceability or transparency. The cattle sector in Brazil, for instance, is still a leading cause of deforestation in the Amazon, partly because their indirect supply chain is difficult to trace. Although the country’s largest cattle processors committed to ending deforestation in an agreement with Greenpeace a decade ago, they still face a major obstacle in detecting and eliminating cases of clearance linked to the suppliers of their direct suppliers.

Holly Gibs, Associate Professor at University of Wisconsin-Madison, explained that ranchers move cattle between properties, so cattle may graze in an area that was recently cleared – and therefore violate zero-deforestation agreements – but ultimately be sold from a property that was cleared long ago. 'There’s way too many holes in the monitoring system that allow most deforestation to flow in and out without any pressure at all', said Gibbs.

While supply chain traceability remains a challenge, tree cover loss data is continually improving. For example, Global Land Analysis and Discovery (GLAD) alerts available through Global Forest Watch allow companies and civil society to monitor land cover change in near-real time. Meanwhile, high-resolution satellite imagery provides further insight into cases of clearance that systems like GLAD detect. For this data to be actionable, though, companies need to better understand their supply chains. As Davis explained, 'Our ability to monitor the deforestation continues to outpace their ability to know where they’re sourcing from.'

More money, no more problems

An employee of a major grain trader, who only agreed to be interviewed on the condition of anonymity, noted that the adoption of on-farm sustainability practices doesn’t earn a premium, making criteria such as zero-deforestation harder to achieve. In other words, deforestation-free products don’t fetch a higher price on supermarket shelves, and this means that producers and traders that operate further upstream in the supply chain aren’t financially rewarded for growing and selling deforestation-free soy, palm oil, or other commodity crops. Lambin pointed out that there’s a high price premium for non-genetically modified soy in Europe, but zero-deforestation soy receives none.

Several others also noted this lack of market incentive.

'There has to be an economic incentive for [traders] to act, so it would be great if there were always a carrot for them', Walker said, noting that she would like to see both incentives and regulations established.

According to Sarah Lake, Managing Director of Supply Chains at Climate Advisers, certification schemes focused on sustainability also have not yielded price premiums for producers and other participants. Palm oil that has been certified by the Roundtable for Sustainable Palm Oil (RSPO), for instance, is usually sold as conventional palm oil because there’s no market incentive to pay a higher price for the RSPO brand. 'In most certifications that I know of, there isn’t a huge price benefit, and if anything, in some, you just lose a lot of money becoming certified. You might get access to a market, but you’re not getting a higher price on the product for it', said Lake.

While zero-deforestation production doesn’t currently earn a price premium, Lake noted that other financial mechanisms show promise and should be more widely adopted: 'I think finance is really important here, and I think there’s a number of avenues for it. I think one is the role of financiers to adopt their own commitments and to implement those commitments by requiring that their clients, often these companies, are enacting sustainability criteria.' She added that such standards are especially important when the companies seeking access to capital are isolated from markets that are demanding sustainable products.

The case for regulation

Among the experts I spoke with, there was also widespread agreement that the zero-deforestation goals will not be achieved without regulatory support. In some contexts, company commitments are more stringent than legislation, disincentivising action to halt deforestation. For example, the Cerrado, the world’s most biodiverse savannah, is currently being lost to soy and cattle production. Most of the Cerrado is located in Brazil, where the country’s Forest Code requires just 20 to 35 percent of producers’ properties located in this biome to remain preserved, thus allowing 65 to 80 percent to be cleared for agricultural production. Civil society is working with major agricultural traders to halt the continued destruction of this ecologically important biome, yet devising solutions has been difficult, partly because much of the ongoing clearance is legal. Traders are reluctant to enact a standard for their companies that is more stringent than Brazilian law.

Furthermore, the adoption of zero-deforestation commitments is not comprehensive enough to cover production of all commodity crops. While a company or set of companies can successfully eliminate deforestation from their own supply chains, they do not represent the entire market. Until there is a market-wide commitment, forest clearance is likely to continue.

'We know even if one company is successful and meets their targets, we can celebrate that, [but] it’s definitely not enough to actually achieve the outcome we’re seeking unless we can get collective action that really captures the whole market', Davis said. 'I don’t think we can rely on voluntary private sector action for 100 percent of actors. It’s just not going to happen.'

Kevin Currey, Program Officer for Natural Resources and Climate Change at the Ford Foundation, agreed: 'Voluntary private sector action is not sufficient. We need regulation in consumer markets to prohibit the import and sale of products laced with deforestation and human rights abuses', he said, adding that regulation can also be a way to level the playing field among corporate actors. 'Those companies that have been serious about trying to clean up their supply chains should look around and see that their competitors are doing nothing, and they’re both getting the same amount of criticism. That’s unfair, and the way to level that playing field is to have stronger regulation that raises the standards for everyone.'

At the same time, Gibbs highlighted the success of the sector-wide Soy Moratorium and noted that there can be challenges with regulation. The Soy Moratorium is a voluntary zero-deforestation agreement in which all major traders committed to stop sourcing soybeans grown on land cleared after July 2006 in the Brazilian Amazon. After the Soy Moratorium was enacted, farmers stopped planting soy in recently cleared land, but they continued converting forest for other agricultural purposes, sometimes clearing more land than Brazil’s Forest Code allowed.

Farmers 'were listening to the signals from the traders and they stopped converting forest to soy but they still deforested for other purposes … and while they were doing that they were nearly all violating the Forest Code by clearing beyond the legal limits', Gibbs said. 'What that suggests is that a soy farmer on the ground may be more likely to listen to those pressures from a trader than to government regulations, which highlights the potential power of the Soy Moratorium to change behavior rapidly.'

Already-cleared land: an untapped resource?

As the global population continues to grow, and is expected to approach 10 billion by 2050, it may seem impossible to feed the world without sacrificing more primary forests and other areas of native vegetation. However, there are large tracts of already-cleared land in commodity-producing countries that could be used to meet growing demand for crops such as oil palm and soy and for cattle grazing. For commodity production to take root on cleared land, producers would need greater incentives to capitalise on this open space, since forested land can otherwise be cheaper.

Walker explained: 'In most countries in the world, where there’s deforestation, there are large areas of underutilized, already-cleared land that can be suitable for crops and cattle, but unfortunately, it can be more difficult or expensive to produce on those areas than to simply go into new areas of forest and burn them down to produce. We would really like to see those incentives change.'

Ultimately, continued clearance will threaten agricultural production, harming producers and companies alike.

'When we look at the data, at least right now, the world can feed itself without needing deforestation, and in fact, in the medium- to long-term deforestation is very bad for yields because forests produce rain and they mitigate against climate change', Walker said.

All hands on deck

Tackling deforestation is clearly no easy task, and it will be impossible for companies to break the link between agricultural expansion and deforestation on their own. Achieving the zero-deforestation commitments will require solutions from both the private and public sectors, along with continual advancements in supply chain traceability and transparency. At the same time, as the 2020 zero-deforestation commitments turn into 2025 or 2030 commitments, the new deadlines shouldn’t leave companies off the hook — we have no time to lose.

Sarah is an environmental scientist and advocate who lives and works in Washington, D.C. She enjoys reading, writing, thinking, and talking about agriculture and adjacent topics.

Art by Florin Prună

Comments